Designed for those who crave the inside scoop on everything from people to policy to profits, each THRIVE episode transforms complex business and HR topics into clear, actionable advice. Whether you’re an entrepreneur, a seasoned business owner, or an aspiring leader, this podcast is your go-to source for cutting through the noise and gaining a competitive advantage.

Episodes

Tuesday Jun 15, 2021

An Economic Forecast: Inflation, Interest Rates, National Debt, and More

Tuesday Jun 15, 2021

Tuesday Jun 15, 2021

The conversation of inflation is definitely in the air, but what exactly is driving it, what are the inflation expectations, and what are the predictions for the next few months and years? Gene Marks is talking with Chief Economist of Moody’s Analytics, Mark Zandi, about just that. Listen in as Mark talks about the impact of inflation, interest rates, the national debt and more, on your business, and the economy.

For a insights into wage and employment trends on a national, regional, state, metro, and industry basis, take a look at the Paychex | IHS Markit Small Business Employment Watch at www.paychex.com/employment-watch.

Check out to Mark's new podcast, Moody's Talks - Inside Economics, that focuses on key indicators and the global economy.

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Thursday Jun 10, 2021

Thursday Jun 10, 2021

As the new ranking member on the Senate Committee on Small Business & Entrepreneurship, Senator Rand Paul sees firsthand how policies affect the working community. Listen in as he speaks with Gene Marks on the unseen aspects of raising minimum wage, the Family and Medical Leave Act, and the PRO Act. While these policies intended for workers sound beneficial, learn why they may actually discourage competition and work incentives in the market.

Paychex continues to speak with policymakers on both sides of the aisle about policies and ideas shaping small businesses. Make sure to follow us so you don't miss out on these upcoming episodes.

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Tuesday Jun 08, 2021

Women in the Workplace: The Past, the Present, and the Future

Tuesday Jun 08, 2021

Tuesday Jun 08, 2021

The Women’s Bureau, part of the Department of Labor, is the only federal agency mandated by Congress to work exclusively on issues that affect women in the workplace and represents their needs as wage-earning women in public policy process. Wendy Chun-Hoon is the Director of the Women’s Bureau, and she recently talked with host Gene Marks about what employers need to know. Listen in as she discusses everything from occupational segregation within certain job sectors, how the pandemic impacted women’s employment, the importance of policy as it relates to paid leave and child and elder care, the employer’s role in helping women thrive in the workplace, and so much more.

Read the rest of this entry »

Tuesday Jun 01, 2021

Tuesday Jun 01, 2021

Veteran unemployment was a national crisis in 2011. Hiring Our Heroes has helped our Veterans and their spouses, connecting them with businesses of all sizes for free. In this episode, Gene Marks explores with Eric Eversole, President of Hiring Our Heroes, the ins and outs of employing a diverse workforce that is focused on problem solving and teamwork. Learn how Hiring Our Heroes have created opportunities, the pros of employing our veterans, and how to secure good employees in today’s 21st century workforce.

Resources:

Learn more about veteran hiring with our article, Changes in Approach by HR Can Improve the Recruiting and Hiring of Military Veterans at www.paychex.com/articles/human-resources/improve-recruiting-and-hiring-military-veterans

See how small businesses in the United States have evolved tremendously over the last decade with our article, The New Generation of Business Owners is Here at www.paychex.com/articles/startup/new-generation-diversity-reshaping-us-small-business.

Visit Hiring our Heroes at www.hiringourheroes.org.

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Thursday May 27, 2021

Employee Retention Tax Credit (ERTC): Answers to Your Most Asked Questions

Thursday May 27, 2021

Thursday May 27, 2021

Hear answers to your most asked questions about the COVID Employee Retention Tax Credit with Andy Gargana, Senior Federal Compliance Analyst at Paychex. The Employee Retention Tax Credit has been extended through the end of 2021. This episode will dive into your most asked questions, including how to interpret the new law, eligibility criteria for your business, and how it is calculated even if you received a PPP loan.

Resources:

For more information on the Employee Retention Credit, read our article, Employee Retention Tax Credit Extended to End of 2021 by American Rescue Plan Act at www.paychex.com/articles/compliance/employee-retention-credit.

For additional resources from the IRS, visit: www.irs.gov/coronavirus-tax-relief-and-economic-impact-payments.

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Tuesday May 25, 2021

Tuesday May 25, 2021

Mental health has increasingly become a hot topic, especially as it relates to work and the workplace. According to Dr. Krystal Lewis, a Clinical Psychologist at the National Institute of Mental Health (NIMH), happier employees leads to more productivity and a happier workspace. But it doesn’t stop there. Just as important is the mental health of you, the business owner. Listen in as she talks to Gene Marks about the importance of making positive mental health a priority. Hear as they talk about everything from transitioning back to the workplace and dealing with work frustrations, to exercise, napping, and getting outside.

Resources:

For more information about mental health in the workplace, download our free guide How Are Your Employees Feeling? A guide to Workplace Mental Health at www.paychex.com/secure/whitepapers/workplace-mental-health-guide.

And for more great mental health resources, visit our Improving Employee Mental Health and Wellness page at www.paychex.com/worx/employee-mental-health.

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

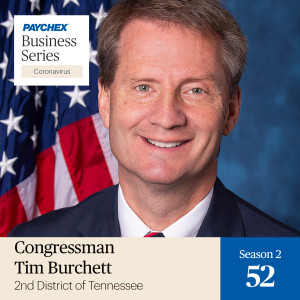

Thursday May 20, 2021

Thursday May 20, 2021

Formerly a businessman himself, Congressman Tim Burchett, the U.S. Representative for Tennessee’s 2nd congressional district, has made it a priority to help business owners in any way that he can. With the introduction of three bills, the Opportunity Zone Extension Act, the Microloan Transparency and Accountability Act, and the Prison to Proprietorship for formerly Incarcerated Act, Congressman Burchett is hoping to give businesses opportunities for tax incentives while also helping people and places in need. Listen in as he talks with Gene Marks about the bills that he is sponsoring, as well as what his thoughts are on labor disruption, unemployment benefits, and getting employees back to work.

Resources:

Interested in other important regulatory challenges you may face? Read our article Top 10 Regulatory Issues Facing Businesses in 2021 at www.paychex.com/articles/compliance/top-regulatory-issues.

For more information about the different types of financing options available to, read the article Securing Financing for Your Small Business at www.paychex.com/articles/finance/securing-small-business-financing.

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

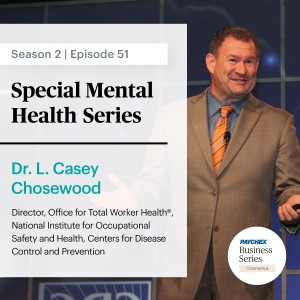

Tuesday May 18, 2021

Tuesday May 18, 2021

The past 15 months have been tough on our entire country. From our physical safety to job uncertainty, isolation to financial stress – people have had to carry a lot on their shoulders. But what does that mean for you as a business owner? A lot says Dr. L. Casey Chosewood, from the Centers of Disease Control. Dr. Chosewood says that by focusing on the Total Worker Health of your employees, you can not only help them, but help your company as well. Hear as he explains the importance of introducing policies, programs, and practices that increase your employees opportunity to become healthier…not just physically, but mentally as well.

Don’t miss Dr. L. Casey Chosewood and Gene Marks at the Paychex Business Conference.

Register now at www.Paychex.com/thrive.

Resources:

For more information about mental health in the workplace, download our free guide How Are Your Employees Feeling? A guide to Workplace Mental Health at www.paychex.com/secure/whitepapers/workplace-mental-health-guide.

Learn more about the NIOSH Total Worker Health® Program at www.cdc.gov/niosh/twh.

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Tuesday May 11, 2021

Tuesday May 11, 2021

Cathleen Swody, Founding Partner and Director of Assessment from Thrive Leadership, talks with Gene Marks about ways employers and employees can improve their mental health with re-entry into the workplace and in a virtual work environment. Hear what she has to say about opening lines of communication, the mental health benefits you can offer to employees, and why business owners should also take some time away.

Resources:

Employees might be struggling more now than ever before brought on by the pandemic, according to a Paychex survey conducted in late 2020. Download our e-book for suggestions on how to make your workplace safe and productive. www.paychex.com/secure/whitepapers/workplace-mental-health-guide

Challenging times are ahead for employers with employees returning to the workplace with mental health stressors. Find critical insights into what employers can do to help at www.paychex.com/articles/human-resources/mental-health-at-work-during-covid19

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Tuesday May 04, 2021

Creating a COVID-Safe, Energy Efficient Workspace

Tuesday May 04, 2021

Tuesday May 04, 2021

Energy efficiency has long been a topic of conversation. Couple that with how the current COVID-19 pandemic has brought the importance of air quality within a building, there’s a lot for business owners to think about. Listen in as Gene Marks talks with Wade Conlan, Commissioning and Energy Discipline Manager at Hanson Professional Services, Inc, about creating a safe physical working environment for your employees. Hear what Wade has to say about getting the most out of your current systems and processes, the future of touchless building design, how business owners can actually save money by being energy efficient, and much more.

Resources:

Looking for more information on creating a safe work environment? Read our article, Workplace Safety Doesn’t Happen by Accident at www.paychex.com/articles/human-resources/workplace-safety-does-not-happen-by-accident.

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Tuesday Apr 27, 2021

Tuesday Apr 27, 2021

When you hear PayPal, you may instantly think e-commerce. But according to Peggy Alford, Executive Vice President of Global Sales for PayPal, the company is helping businesses of all kind – both online and offline – to create a seamless commerce journey. Listen in as she talks with host, Gene Marks, about changing consumer expectations, how PayPal is helping businesses go global, and more.

Resources:

To hear more ideas on how companies are adapting their business, read our article, Adapting Your Business to the New Normal at www.paychex.com/articles/human-resources/adapting-to-the-new-normal.

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Tuesday Apr 20, 2021

Tuesday Apr 20, 2021

When it comes to infectious diseases and infection prevention, Saskia Popescu, is an expert. As an Assistant Professor in the Biodefense Program at the Schar School of Policy and Government at George Mason University, Saskia knows the incredible impact that infectious disease can have on society – whether it be on a pandemic, or on a smaller scale. On this episode, Saskia is talking with host Gene Marks and sharing what they’ve learned about COVID-19 and intervention strategies, including masks, cleaning surfaces, temperature checks, vaccination, and travel safety, and how business owners can work to create a safer environment for their employees and customers.

Resources:

Wondering what role, if any, your organization should play in motivating employees to get the COVID-19 vaccine? Watch our webinar, Vaccination and the Workplace: Key Considerations at www.paychex.com/secure/seminars/covid-vaccine-in-workplace.

Learn more about promoting workplace safety during COVID-19 with our article, Workplace Safety and Returning to Work: Guidance for COVID-19 at www.paychex.com/articles/human-resources/workplace-safety.

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Tuesday Apr 13, 2021

Tuesday Apr 13, 2021

As America starts reopening and vaccinations start ramping up, Paychex Small Business Employment Watch shows a significant increase in job growth in March, the highest rate seen in eight years. Curious about what this all could mean for employment in the small business sector?

Gene Marks speaks with Frank Fiorille, VP of Risk, Compliance, and Data Analytics from Paychex, to dive into the current trends for hiring, unemployment, and wages for small businesses.

Also, learn about what opportunities are available for COVID-19 relief that small businesses must take advantage of.

If you enjoyed this episode, make sure to hit follow so you won’t miss out on the latest small business insights.

Follow Paychex on Facebook @Paychex and Instagram @Paychex_Inc

Follow Gene Marks on Twitter @genemarks

Resources:

View the latest results of the Paychex Small Business Employment Watch at www.paychex.com/employment-watch

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Tuesday Apr 06, 2021

Tuesday Apr 06, 2021

Goldman Sachs saw the large impact that the small business community has on the U.S. economy and on our communities, and decided to launch the 10,000 Small Businesses program, a philanthropic initiative that provides education, capital, and support services. Eleven years since it’s launch, the program has just over 10,000 graduates. Listen in as Joe Wall, Managing Director of Government Affairs at Goldman Sachs, and National Director of 10,000 Small Businesses, talks with Gene Marks about this great program and how it’s helping small businesses find success.

Resources:

Learn more about the 10,000 Small Businesses Program by visiting www.goldmansachs.com/citizenship/10000-small-businesses/US/.

To learn more about best practices to help you manage your business download our free resource, An Essential Guide for Business Owners and Managers at www.paychex.com/secure/whitepapers/essential-guide-business.

Looking for more information on small business financing options? Read our article, Securing Financing for Your Small Business at www.paychex.com/articles/finance/securing-small-business-financing.

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Tuesday Mar 30, 2021

Tuesday Mar 30, 2021

What started out as a “side job” for Kat and Jethro Gilligan Toth, quickly turned into a focus for both. Their “Box of Oddities” podcast, has reached nearly 10 million views in just 2 years. Listen in as Kat and Jethro talk with host Gene Marks about how they came up with the idea, what they’ve done to market their podcast, how they are using social media, the importance of networking, and tips for those looking to start their own podcast.

Resources:

To learn more about how to market your business, download our free whitepaper, Startup Guide: Market Your Business, at www.paychex.com/secure/whitepapers/market-your-business.

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Tuesday Mar 23, 2021

Tuesday Mar 23, 2021

Historically, black-owned businesses have faced a unique set of social, financial and policy challenges that have created disparities that are difficult to overcome. That’s why the Philadelphia 76ers along side of David Gould, Chief Diversity and Impact Officer, have made a commitment leveraging their organization to help these businesses succeed. Listen in as David talks with Gene Marks about the history of black-owned businesses and how that has impacted them today, resources that are available to these business owners, and how the Sixers “Buy Black Program” is providing resources for local businesses.

Resources:

Looking to understand more about diversity and inclusion as it relates to your business? Read our article, “Diversity and Inclusion in the Workplace" at www.paychex.com/articles/human-resources/diversity-and-inclusion-in-the-workplace.

Learn more about the Buy Black program at www.nba.com/sixers/community/buy-black.

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Tuesday Mar 16, 2021

Tuesday Mar 16, 2021

With the signing of the American Rescue Plan Act of 2021 by President Biden on March 11, 2021, there have been some changes and additions to tax credits that business owners should know. On the third episode of this three-part series, Andy Gargana, Senior Federal Compliance Analyst at Paychex, is talking with Gene Marks about everything you need to know when it comes to tax credits under the third stimulus. Listen in as they talk Employee Retention Tax Credit (ERTC), the Families First Coronavirus Response Act, the new COBRA tax credit, and much more.

Resources:

To find out more about what’s in the third stimulus bill and how it’s impacting small businesses, read our article “President Signs $1.9 Trillion American Rescue Plan Act.”

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Tuesday Mar 16, 2021

Tuesday Mar 16, 2021

On March 11, 2021 President Biden signed the American Rescue Plan Act of 2021 into law. This $1.9 trillion stimulus bill includes modifications and changes to the Paycheck Protection Program and the Economic Injury Disaster Loan (EIDL). Listen in to part two of this three part series as Gene Marks talks with Paychex Compliance Analyst, Connor Mykins, about the expansion of these two programs and what small business owners need to know, including an expansion of the Paycheck Protection Program (PPP) and the Economic Injury Disaster Loan (EIDL), the approaching March 31st deadline for the PPP, and more.

Resources:

To find out more about what’s in the third stimulus bill and how it’s impacting small businesses, read our article “President Signs $1.9 Trillion American Rescue Plan Act.”

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Friday Mar 12, 2021

Friday Mar 12, 2021

On March 11, 2021, President Biden signed into law the $1.9 trillion stimulus bill, also known as the America Rescue Plan Act. In this first episode of a three part series, host Gene Marks is talking with Senior Manager of Government Relations for Paychex, Thad Inge, about everything you need to know. Hear about the updates to the Paycheck Protection Program, the Economic Injury Disaster Loans, the Employee Retention Tax Credit, Families First Coronavirus Response Act, as well as how this relief bill is helping the hard hit restaurant industry.

Resources:

Visit our COVID-19 Help Center for the latest tools and resources at paychex.com/coronavirus-resources.

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Tuesday Mar 09, 2021

Tuesday Mar 09, 2021

If you are a small business owner, a 401(k) plan is within your reach. Your business is never too small to offer a 401(k). With costs for starting a 401(k) for you and your employees at an all-time low, now is the time to give it another consideration.

Gene Marks sits down with Daniel Notto and Meghan Jacobson from J.P. Morgan to simplify federal incentives, which can help make a 401(k) obtainable for your small business. Also, learn how a 401(k) is a way to help your small business attract and retain talent to gain a competitive edge.

Resources:

Download our free whitepaper: How a 401(k) Can Give Your Business a Competitive Edge

View our article: The SECURE Act 2.0: A Look Ahead for 2021

Read Dan Notto's bulletin: Congress Enacts Major Retirement Plan Legislation

Read Meghan Jacobson's 401(k) Small Business Survey

If you enjoyed this episode, make sure to hit follow so you won’t miss out on the latest small business insights.

Follow Paychex on Facebook @Paychex and Instagram @Paychex_Inc

Follow Gene Marks on Twitter @genemarks

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Tuesday Mar 02, 2021

Andrew Zimmern Talks About the Challenges Facing the Restaurant Industry

Tuesday Mar 02, 2021

Tuesday Mar 02, 2021

Andrew Zimmern started off working in the restaurant industry when he was 14 years old. Today, he is one of the most knowledgeable personalities in the food world. Andrew has spent his career learning everything he could about the restaurant business and industry – from the kitchen and operations all the way to marketing and policy. Now, he’s talking with Gene Marks about the state of the industry, before, during, and after the onset of the COVID-19 pandemic. If you are a chef, restaurant manager, budding restaurateur, or anything in between, this is a must listen to episode.

Resources:

For information on running your restaurant, check out our guide: Run Your Restaurant without Running Ragged.

Get the information you need in your road to recovery by downloading our free guide: SMBs & COVID-19: Peer Insights for Rebuilding and Recovery.

Follow Paychex on Facebook @Paychex, Instagram @Paychex_Inc, and Twitter at @Paychex

Follow Gene Marks on Twitter @genemarks

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Tuesday Feb 23, 2021

Tuesday Feb 23, 2021

When Ron “Boss” Everline decided to open a gym, he never realized what an impact he could make on individuals’ lives. That’s when he realized that training people was his calling in life. Now, 11 years later, Ron’s company Just Train, has over 1 million followers on Instagram. Listen in as he talks about, why he chose Instagram over other social media platforms, how he’s used it to help authentically build a following and referral source for his company, how he has positioned himself to stand out amongst a crowded market, building a brand, and more.

Resources:

To get more tips on social media strategies, read our article 5 Minutes a Day to a Better Social Media Strategy.

For more great information on how to market your business, download our free guide Startup Guide: Market Your Business.

Follow Paychex on Facebook @Paychex and Instagram @Paychex_Inc

Follow Ron "Boss" Everline on Instagram @justtrain

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Tuesday Feb 16, 2021

Pivoting Your Business (and Thriving) During COVID

Tuesday Feb 16, 2021

Tuesday Feb 16, 2021

With COVID-19 changing consumer buying behavior, small businesses have had to pivot quickly to meet customers where they are. For small business owners, how do you know if you are making the right decision when considering offering online payments or upgrading your payment technology?

In this episode, Gene Marks tackles these tough questions with Leslie Pearce, Senior VP of Inside Sales at Fiserv. You will hear in-depth insights into what small business owners need to succeed, and how a POS platform such as Clover can simplify these challenging tasks for a small business owner. In addition, Leslie provides details around the Fiserv Back2Business program, a multi-pronged initiative to invest $50 million in minority-owned business owners and the ecosystem of community organizations serving diverse entrepreneurs.

Resources:

Learn how businesses across the U.S. are pivoting to a new normal in our whitepaper SMBs & COVID-19: Peer Insights for Rebuilding and Recovery.

The Fiserv Back2Business program is accepting grant applications from minority-owned small businesses in Atlanta, Chicago, Milwaukee, New Jersey, New York, and soon to be Oakland. Qualifying businesses can receive up to $10,000 in COVID relief funds. Businesses can apply at aeoworks.com/Fiserv.

If you enjoyed this episode, make sure to hit follow so you won’t miss out on the latest small business insights.

Follow Paychex on Facebook @Paychex and Instagram @Paychex_Inc

Follow Fiserv on Twitter @fiserv and LinkedIn @fiserv

Follow Clover on Twitter @clovercommerce and on Instagram @clovercommerce

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Tuesday Feb 09, 2021

Tuesday Feb 09, 2021

As ranking member of the House of Representatives Small Business Committee, Congressman Blaine Luetkemeyer has some insight into some key economic topics affecting small business owners today and in the future. From his stance on the proposed national minimum wage increase, current unemployment benefits, and the national debt to the hot topic of worker classification, where he sees the future of bi-partisan agreements, and more – hear what he has to say in this episode of our business podcast.

Interested in learning more about key topics impacting businesses? Read our article, Top 10 Regulatory Issues Facing Businesses in 2021.

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Tuesday Feb 02, 2021

Senator Cory Booker Provides Insights for Small Business Owners

Tuesday Feb 02, 2021

Tuesday Feb 02, 2021

On this episode of the Paychex Business Series podcast, host Gene Marks is talking with U.S. Senator Cory Booker of New Jersey. Hear what the senator has to say about the minimum wage increase to $15 an hour and what that means for small business owners, the focus on low- and moderate-income area businesses in the new stimulus bill, and potential bipartisan agreements we may see in the future that will help the country as a whole.

Learn more about the recent stimulus bill by reading, “Nearly $900B Relief Act Becomes Law, Includes Funds for Second Round of Paycheck Protection Program Loans.”

Stay tuned for episode 35 as we'll be speaking with Congressman Blaine Luetkemeyer (R-MO) and getting his thoughts on the current economic status.

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Wednesday Jan 27, 2021

How the Second Stimulus Bill is Providing Tax Benefits for All Businesses

Wednesday Jan 27, 2021

Wednesday Jan 27, 2021

Whether you have been impacted by COVID-19 or not, the new stimulus bill has some tax benefits that may help your business. In this episode of the Paychex Business Series podcast, host Gene Marks and guest Andy Gargana, Senior Federal Compliance Analyst at Paychex, are digging into these benefits. Hear as they talk about deferred taxes, tax credit for the Families First Coronavirus Relief Act (FFCRA), the different types of employment tax credits available, as well as the tax benefit if you lost money in 2020, 2019, or 2018.

Learn more about the recent stimulus bill by reading, “Nearly $900B Relief Act Becomes Law, Includes Funds for Second Round of Paycheck Protection Program Loans.”

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Tuesday Jan 26, 2021

Everything You Need to Know About the Employee Retention Tax Credit (ERTC)

Tuesday Jan 26, 2021

Tuesday Jan 26, 2021

On December 27, 2020, the new COVID-19 fiscal relief package was signed into law. One of the significant changes that came with this second stimulus bill is to the Employee Retention Tax Credit (ERTC). In this episode, Gene Marks is talking with Stephen Dombroski, Senior Compliance Manger at Paychex. Hear everything you need to know about the ERTC, including what it is, who’s eligible, and how to claim it.

Learn more about the recent stimulus bill by reading, “Nearly $900B Relief Act Becomes Law, Includes Funds for Second Round of Paycheck Protection Program Loans.”

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Monday Jan 25, 2021

How the New Stimulus Bill is Helping Businesses in the Arts Industry

Monday Jan 25, 2021

Monday Jan 25, 2021

The new Stimulus Bill includes a grant program dedicated to businesses in the arts industry that have been hit hard during the COVID-19 pandemic. With the Shuttered Venue Operator (SVO) Grant Program, $15 billion in grants have been dedicated to helping live venues that have seen a 25% or greater loss in revenue in 2020. Hear what Thad Inge, Senior Manager of Government Relations at Paychex, has to say about the requirements of this new grant, who qualifies, and more.

Learn more about the U.S. Small Business Administration’s Shuttered Venue Operator Grant Program.

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Monday Jan 25, 2021

Monday Jan 25, 2021

The new Stimulus Bill has brought more loans and grants for businesses in the U.S. But did you know that your address could help you during this process? When looking back at the data from last round of Paycheck Protection Program (PPP) loans, many businesses in low- and moderate-income (LMI) areas were overlooked. Listen in as Thad Inge, Senior Manager of Government Relations, talks with Gene Marks about how the new PPP is focusing on businesses in underserved areas.

Visit our website to learn more about the Paychex Protection Program and how businesses can qualify for a second round.

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Friday Jan 22, 2021

Friday Jan 22, 2021

In the most recent Stimulus Bill, $20 billion is set to fund the Economic Injury Disaster Loans (EIDL), providing businesses with two options: apply for up to two million dollars with a 30-year maturity, and/or apply for a grant that is $1,000 per employee, up to $10,000. Find out more details on the EIDL and what it means for your business as host Gene Marks talks with Thad Inge, Senior Manager of Government Relations at Paychex.

To apply for an EIDL loan or grant, visit sba.gov.

Visit our website for additional resources on the fiscal relief package.

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Friday Jan 22, 2021

A Second PPP is Here – Get the Facts and Guidance You Need

Friday Jan 22, 2021

Friday Jan 22, 2021

With the latest Stimulus Bill came a new round of Paycheck Protection Program (PPP), including opportunities for a second draw. Tune in as Gene Marks talks with Connor Mykins, compliance expert at Paychex, as they discuss key takeaways from this more targeted program, including another round of loans, required documentation, approved expenses, and loan forgiveness.

Visit our website to learn more about the Paychex Protection Program and how businesses can qualify for a second round.

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Tuesday Jan 12, 2021

Managing the Future of a Successful 150 Year Old Family-Owned Business

Tuesday Jan 12, 2021

Tuesday Jan 12, 2021

Founded in 1870, Graeter’s Ice Cream is on it’s fourth generation of family ownership. President and CEO of Graeter’s, Richard Graeter, knows that when it comes to running a business, innovation is important to keep up with the times. He also knows that while looking towards the future, it is important to honor the past and what has made them successful. In this episode, Richard talks with host Gene Marks about why they choose to continue using the slower, labor-intensive process of ice cream-making that his great-grandmother used 150 years ago and how that has helped differentiate them, the importance of trust in the transition of a family-owned business from one generation to another, the benefit of bringing on non-family talent, and more.

For more tips and insights on how to avoid conflict in a family business, read our article, “Managing Family Business Conflicts for the Good of the Company.”

Looking for ways to get back to business during COVID-19? Download our whitepaper, “Peer Insights to Help SMBs Get Back to Business.”

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Tuesday Jan 05, 2021

Adapting As We Go – The Story Of GOOD PLANeT FOODS During COVID-19

Tuesday Jan 05, 2021

Tuesday Jan 05, 2021

Bart Adlam joined on as co-CEO of GOOD PLANeT FOODS in the midst of a global pandemic. With just three months under his belt as a partner in this plant-based products company, Bart shares with host Gene Marks his experience growing a business during 2020. Listen in as he talks about the food service business, running a business from home, the importance of not waiting for things to change, expanding internationally, and managing expectations as a new partner.

Looking for ways to get back to business during COVID-19? Download our whitepaper, “Peer Insights to Help SMBs Get Back to Business.”

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Tuesday Dec 29, 2020

Tuesday Dec 29, 2020

As businesses continue to struggle as a result of the Covid-19 pandemic, a new stimulus bill was passed on December 27, 2020 to help alleviate payments for new and existing loans given to small businesses within this past year. Join us as Gene Marks talks with Senator Chris Coons from Delaware on these unbelievable benefits for small businesses including lending through the Paycheck Protection Program, small business debt relief, and many other provisions that will provide more than $300 billion to small businesses and nonprofits all over the nation.

If you’re looking for more specifics on key provisions of the law, visit our website for additional resources on the fiscal relief package.

Looking for ways to get back to business during COVID-19? Download our whitepaper, “Peer Insights to Help SMBs Get Back to Business.”

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Wednesday Dec 23, 2020

Nicolle Wallace Talks Hope, Optimism, and Opportunity for Small Businesses

Wednesday Dec 23, 2020

Wednesday Dec 23, 2020

Hope. Optimism. Opportunity. Three powerful words that mean more this year than in years past. In this episode of the Paychex Business Series, Gene Marks is talking with host of Deadline: White House, Nicolle Wallace about what has come out of COVID-19 for small businesses and where the future may lie. Hear as they talk about the opportunity working from home has created for both employers and their employees, why startups are not just for people looking to make extra money, the importance of valuing your millennial employees, and how to make the mental health of your employees a priority.

For more information on employee mental health, read our article, “Mental Health at Work During COVID-19.”

Looking for ways to get back to business during COVID-19? Download our whitepaper, “Peer Insights to Help SMBs Get Back to Business.”

DISCLAIMER:

This episode was recorded on December 15, 2020. The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Tuesday Dec 22, 2020

Congress and Small Business, with Congresswoman Nydia Velázquez

Tuesday Dec 22, 2020

Tuesday Dec 22, 2020

New parameters around Paycheck Protection Program funding. COVID-19 liability protection. Potential increases to the minimum wage. The importance of affordable health care for small business owners. The challenges of big tech and need to establish a level playing field for small business owners to succeed, not only during these trying times, but also into the future. Listen in as we discuss these issues and more with Congresswoman Nydia M. Velázquez, Chairwoman of the House Small Business Committee. If you want a feel for what Congress plans to do to address the most pressing business challenges of today, and what to expect from them in 2021, this episode is for you.

Want to hear what else 2021 may bring for taxes, health care, regulations, and more? Watch a recording of our special digital event, The Business Impacts of the 2020 Elections: A National Perspective.

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Tuesday Dec 15, 2020

Tuesday Dec 15, 2020

Inspiration for a business can come from anywhere. For Sharad Mohan, Co-Founder and CEO of Trainerize, found it in 2003 while working with a physiotherapist. Hear as Sharad talks with host Gene Marks about his journey from ideation to realization, the bumps along the way, why defining a new category may be the key to a successful business, and where he sees himself going in the future.

Looking for ways to get back to business during COVID-19? Download our whitepaper, “Peer Insights to Help SMBs Get Back to Business.”

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Tuesday Dec 08, 2020

How Amazon is Supporting Small Businesses During COVID-19 and Beyond

Tuesday Dec 08, 2020

Tuesday Dec 08, 2020

When you think of Amazon, small businesses are probably not the first thing that comes to mind. But maybe it should be. With more than half of the products sold on Amazon coming from small- and medium-sized businesses, Keri Cusick, Head of Small Business Empowerment at Amazon says small businesses are a fundamental part of their work. Hear what she has to say about what the company is doing to support small businesses, their focus on the customer experience, and what trends they’ve seen over the past few months.

Looking for ways to get back to business during COVID-19? Download our whitepaper, “Peer Insights to Help SMBs Get Back to Business.”

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Tuesday Dec 01, 2020

Paychex Panel Experts: Post Election Hot Topics

Tuesday Dec 01, 2020

Tuesday Dec 01, 2020

With the election behind us, many are wondering what to expect with the new Biden administration. Join Gene Marks as he talks with three experts from Paychex: Thad Inge, Senior Manager of Government Relations, Mike Trabold, Director of Compliance Risk, and Laurie Savage, Senior Compliance Analyst. Listen in as this panel talks about what business owners may see under president-elect Joe Biden, including the next round of stimulus, FICA tax, minimum wage and overtime laws, health care, 401(k) plans, and more.

Join us for our upcoming webinar on December 15, The Business Impacts of the 2020 Elections: A National Perspective, with host Gene Marks, and guests Rebecca Jarvis and Nicolle Wallace. Register today!

DISCLAIMER:

This episode was recorded on November 20, 2020. The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Wednesday Nov 25, 2020

Special Episode with Congressman Steve Chabot, Member of the Committee on Small Business

Wednesday Nov 25, 2020

Wednesday Nov 25, 2020

Listen in as Ohio Congressman, Steve Chabot, joins us for a special episode of the Paychex Business Series podcast. Hear as he talks with Gene Marks about his role as a member of the Committee on Small Business, the status of the new stimulus package, business liability in the COVID-19 era, Paycheck Protection Program loan forgiveness, and what business owners hope to see in the next two years.

Looking for ways to get back to business during COVID-19? Download our whitepaper, “Peer Insights to Help SMBs Get Back to Business.”

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Tuesday Nov 24, 2020

Inside the World of a Business Journalist

Tuesday Nov 24, 2020

Tuesday Nov 24, 2020

Have you ever wondered how business journalists are able to write about the topic, without many having ever owned a business of their own? While Zach Warmbrodt, financial services reporter at POLITICO, may not be a business owner, he’s made a career out of providing commentary on a lot of the things that affect them. In this episode, Gene talks with Zach about the life of a business journalist, his take on the PPP, the rise of Fintech, and more.

Looking for ways to get back to business during COVID-19? Download our whitepaper, “Peer Insights to Help SMBs Get Back to Business.”

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Tuesday Nov 17, 2020

Tuesday Nov 17, 2020

You’ve thought of a new idea for a product or business…now what? Well, according to Richard Gearhart, founding partner of Gearhart Law, the first thing you should do is to get in touch with an intellectual property professional. Hear as Richard talks with host, Gene Marks about the difference between patents, trademarks, and copyrights; the importance of protecting your intellectual property; and why getting advice from an attorney sooner is better.

Thinking about starting a business? Be sure to read our article, “Starting a Business Checklist: Tips for Your New Launch.”

Looking for ways to get back to business during COVID-19? Download our whitepaper, “Peer Insights to Help SMBs Get Back to Business.”

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Thursday Nov 12, 2020

The Business Impacts of the 2020 Elections: First Impressions with Thad Inge

Thursday Nov 12, 2020

Thursday Nov 12, 2020

The results of the 2020 election will likely bring many changes for your business; in this episode, Gene talks with Thad Inge, Senior Manager of Government Relations at Paychex, about some of the most common questions being asked by business owners today, and what you can anticipate from the new administration.

Want to learn more about the business impacts of the 2020 election? Register for our upcoming webinar, The Business Impacts of the 2020 Elections: First Impressions, and learn how to jump on all these potential changes.

Looking for ways to get back to business during COVID-19? Download our whitepaper, “Peer Insights to Help SMBs Get Back to Business.”

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Tuesday Nov 10, 2020

Tuesday Nov 10, 2020

No longer just lending institutions, banks have become financial consultants. That’s why it's so important for small business owners to build a strong relationship with their bank. Steve Zandpour, U.S. Head of Retail Specialty for BMO Harris Bank, joins host Gene Marks to give insight into the banking side of business. Hear what he has to say about the Paycheck Protection Program, Small Business Administration loans, competition in the lending industry, banker relationships and more.

To learn more about different types of small business financing options during the COVID-19 pandemic as well as lender options, read our article “Securing Financing for Your Small Business.”

Looking for ways to get back to business during COVID-19? Download our whitepaper, “Peer Insights to Help SMBs Get Back to Business.”

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Tuesday Nov 03, 2020

Tuesday Nov 03, 2020

What do China, New York City, and Washington, D.C. all have in common? According to Matthew Yglesias, co-founder of Vox.com, it’s larger populations and strong economies. Listen in as Matt talks with host Gene Marks about why he believes a bigger population would be beneficial for the United States. Hear as he talks about his stance on how the U.S. can become the #1 economy, why immigration is so important, how we should learn to look at the country’s deficit, and what he thinks about healthcare as it relates to businesses.

Looking for how to get back to business during COVID-19? Download our whitepaper, “Peer Insights to Help SMBs Get Back to Business.”

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Tuesday Oct 27, 2020

Tuesday Oct 27, 2020

Listen in as Rebecca Jarvis, chief business, technology & economics correspondent for ABC News, shares hard data and smart insights around significant “macro” issues small business owners need to be mindful of as they prepare for the weeks and months ahead. Rebecca and Gene discuss pent-up consumer demand and the coming holiday season, direct-to-consumer marketing, eCommerce, and opportunities with Amazon, more intentional spending habits and a renewed commitment to shop local, the unique challenges faced by women, as entrepreneurs and in the workplace, and much more.

Want to know what other business owners are doing to get back to business during COVID-19? Download our whitepaper, “Peer Insights to Help SMBs Get Back to Business.”

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Tuesday Oct 20, 2020

When it Comes to Small Business Loans, Online Lending May Be the Answer

Tuesday Oct 20, 2020

Tuesday Oct 20, 2020

Finding loans for your small business can be a challenge – your company is not as big, you may be looking to borrow smaller amounts of money, or you may need your loan faster than a large bank can provide it. OnDeck, is an online lender company focused on the small business customer. In this episode, Gene Marks talks with Noah Breslow, Chief Executive Officer and Chairman of the Board of Directors at OnDeck. Hear what Noah has to say about the service OnDeck provides, the online experience of applying for a loan, bridge loans, and more.

For more information about small business loans, read our article, “Securing Financing for Your Small Business.”

Looking for how to get back to business during COVID-19? Download our whitepaper, “Peer Insights to Help SMBs Get Back to Business.”

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Tuesday Oct 13, 2020

Tuesday Oct 13, 2020

Building and maintaining customer relationships is more important now than ever before. With that in mind, many businesses are looking into customer relationship management (CRM), and may be asking themselves, “Is it time to invest in CRM software?” In this episode, Meredith Schmidt, Executive Vice President, General Manager of Salesforce Essentials and SMB at Salesforce, is talking with Gene Marks about the importance of CRM for small businesses, how to be sure you are taking full advantage of the software capabilities, the future of Salesforce, and more.

For more ideas on how to connect with customers, read our article, “How Microbusinesses Can Build Customer Relationships.”

Looking for how to get back to business during COVID-19? Download our whitepaper, “Peer Insights to Help SMBs Get Back to Business.”

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Tuesday Oct 06, 2020

How Companies Are Changing The Way They Do Business With Facebook

Tuesday Oct 06, 2020

Tuesday Oct 06, 2020

Social media platforms such as Facebook and Instagram have become increasingly popular for use by small businesses as a tool for marketing, facilitating store traffic, and completing transactions. In this episode, host Gene Marks talks with Rich Rao, Vice President of Small Business at Facebook. Hear what he has to say about the increasing trend of small businesses entering the eCommerce space, how companies are using social media as a form of communication with their customers, what features Facebook provides small business owners, and where he sees the future of the Facebook Small Business group going to help companies be successful.

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.

Tuesday Sep 29, 2020

The FruitGuys CEO Shares His Story On Business Model Innovation During COVID-19

Tuesday Sep 29, 2020

Tuesday Sep 29, 2020

As many work environments changed with the onset of COVID-19 from in office to remote working, the impact was felt heavily for The FruitGuys, a company that delivers fresh fruit to businesses around the United States. That’s when Chris Mittelstaedt, CEO and Founder of The FruitGuys, had to become creative and reimagine how his company would navigate these uncertain times. Hear as he talks with host Gene Marks about how The FruitGuys has changed their business model and evolved over the past six months to keep the business going, how they are working to help support small farmers, how they have managed to run a nonprofit to help feed the hungry, and where he sees the future of supply chain and office working in the future.

Visit our Coronavirus (COVID-19) Help Center for more information on navigating your business.

DISCLAIMER:

The information presented in this podcast, and that is further provided by the presenter, should not be considered legal or accounting advice, and should not substitute for legal, accounting, or other professional advice in which the facts and circumstances may warrant. We encourage you to consult legal counsel as it pertains to your own unique situation(s) and/or with any specific legal questions you may have.